A "liquor sales business license" is required to sell alcoholic beverages, including liquor sales at restaurants and retail stores, mail order sales through online stores, and wholesale for commercial use.

In order to sell alcoholic beverages, it is necessary to obtain a "liquor sales business license" in accordance with the law. There are detailed regulations regarding the types of licenses and application procedures, so it is important to be well prepared in advance. This article explains the application process for a liquor sales business license and the necessary documents in an easy-to-understand manner. If you are considering selling alcoholic beverages in the future, please refer to this article.

People who should read this article

People who want to sell alcohol but don't know where to start.

Anyone planning to open a liquor store

Anyone considering selling alcoholic beverages in the restaurants they manage.

People who want to sell imported wines by mail order.

People who have tried to apply for a license to sell alcoholic beverages on their own but have been frustrated by the difficulties.

In the previous article, we explained the characteristics of a "liquor license".

This article will guide you through the actual application process.

Application for liquor sales license

Preparation of application documents

When applying for a license to sell alcoholic beverages, the following documents are required in addition to the application form.

The required documents differ depending on the license category. The following is a list of required documents using a general liquor retailer license as an example.

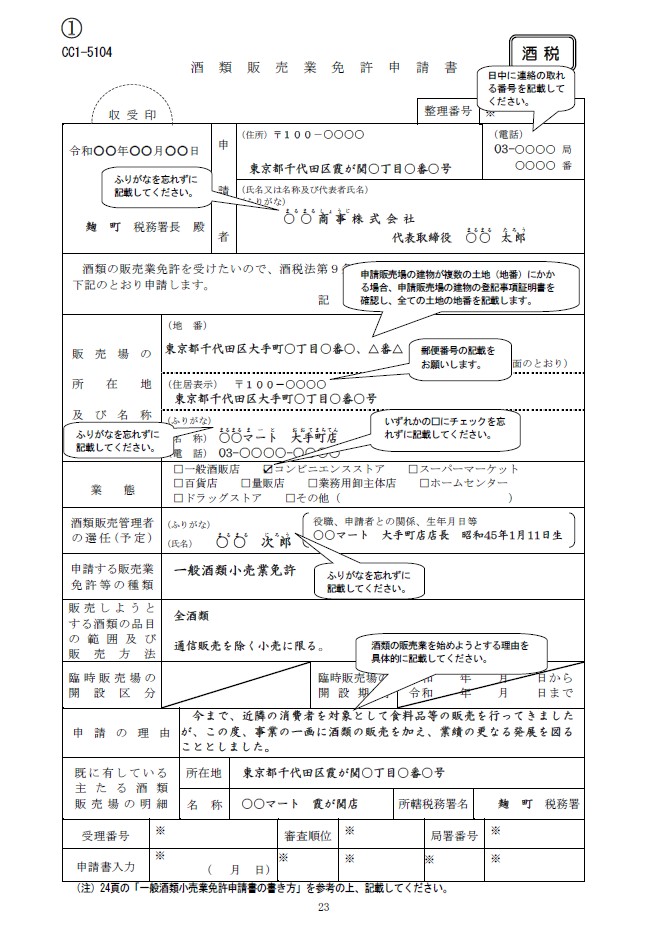

- Liquor Sales License Application Form

- Condition of the site of the sales lot (next leaf 1)

- Layout of buildings, etc. (next leaf 2)

- Outline of the project (next leaf 3)

- Estimated income and expenditures (next leaf 4)

- Amount of funds required and method of financing (next leaf 5)

- Plan of action on how to manage the sale of alcoholic beverages (next leaf 6)

- License Requirement Pledge for Liquor Sales License

- Curriculum vitae of the applicant (for corporations, for all board members)

- Copy of Articles of Incorporation (for corporations)

- Copy of lease agreement, etc.

- Building Use Consent Form

- Tax payment certificate from the prefecture (for application for liquor sales license)

- Tax payment certificate from the municipality (for application for liquor sales license)

- Financial statements and income/expense plans for the last three years

- Certificate of all items of the building

- Certificate of all items of land

- Bank deposit certificate

- Supplier's transaction approval letter

- Certificate of participation in liquor sales management training

- Application Documents Checklist

(Source: National Tax Administration Agency, Guide to Applying for a General Liquor Retailer's License)Guide to applying for a general liquor retailer's license|National Tax Agency)

2. submission of application form

The prepared application and supporting documents should be submitted to the sales office atSubmit to the tax office with jurisdictionI will do so.

The sales area here refers to all locations where alcoholic beverages are actually sold, for example, if the head office and two branch offices sell alcoholic beverages,It is not sufficient to apply for a liquor sales business license only at the head office in one lump sum, as the application must be made not only at the head office but also at each of the two branch offices.

In addition, since the liquor sales license is granted to a specific location and a specific person, it is necessary to apply for a new license when a business is succeeded or inherited, when a company is merged, or when a sole proprietorship becomes a corporation.

Review of applications

The submitted application form and attached documents will be examined by a "liquor advisor" at the tax office in the order received to ensure that the application is complete and that the application form and sales area meet the requirements for a liquor sales business license.

During the license review process, the tax office may ask for explanations andA site inspection may be conducted.In addition, in reviewing licenses, the opinions of the Retail Liquor Merchant Association may be sought from the perspective of ensuring the effectiveness of the review process.

The standard processing time for a license to sell alcoholic beverages is approximately two months.Please note, however, that if the submitted documents are incomplete and you are ordered to correct them, the processing time will stop counting and it will take approximately two months from the date the correction is completed.

4. notification of license grant

If, as a result of the examination, a license is granted, the applicant will be notified in writing with a "Liquor Sales License Notification Letter". If the license is not granted, the applicant will also be notified in writing.

5. payment of registration and license tax

Once the liquor sales license is granted, the registration tax must be paid.

The tax office will notify you with a "Notice of Payment of Registration and License Tax for Liquor Retailer's License" and you will pay the registration and license tax at the tax office or a financial institution. The amount of the registration tax is 30,000 yen per license for a liquor retailer's license.

After payment of the registration and license tax is completed, the original receipt of the registration and license tax must be attached to the "Registration and License Tax Receipt Submission Form" sent by the tax office and submitted to the director of the tax office by the designated date.

6. appointment of liquor sales manager

When a retail liquor license is obtained, a "liquor sales manager" must be appointed by the time the liquor sales business is commenced, and a "Notification of Appointment of Liquor Sales Manager" must be submitted to the tax office where the license was obtained within two weeks.

Failure to appoint a liquor sales manager is punishable by a fine of up to 500,000 yen, pursuant to the provisions of the Law Concerning the Preservation of Liquor Tax and Liquor Industry Associations.

1. A liquor distributor must appoint a liquor sales manager by the time it commences liquor sales operations and notify the competent district director of taxation to that effect within two weeks. Failure to appoint a liquor sales manager is punishable by a fine of up to 500,000 yen in accordance with the provisions of the Liquor Tax Law.

2. A liquor sales manager must be appointed from among persons who meet the following conditions

(1) Persons engaged in the business of selling alcoholic beverages

(2) Those who have received liquor sales management training within the past three years.

(3) Those who do not fall under the following (1) to (3)

(1) Minors

(ii) A person who is unable to properly perform the cognition, judgment and communication necessary to properly perform the duties of a sales manager of alcoholic beverages due to an injury to his/her mental functions.

(iii) Persons who fall under the provisions of Article 10, Item 1, Item 2 or Items 7 through 8 of the Liquor Tax Law.

(4) Those who are expected to be continuously employed by the alcoholic beverage retailer for a period of six months or longer (including relatives who share the same livelihood with the alcoholic beverage retailer and those whose employment period is not fixed).

(5) Persons who have not been appointed as liquor sales managers at other sales outlets

3. the role of the liquor sales manager.

The liquor sales manager provides necessary advice and guidance to employees and others engaged in the retail or sales of alcoholic beverages to ensure that they perform their duties in compliance with the laws and regulations governing the business of selling alcoholic beverages. Liquor retailers must respect the advice of the liquor sales supervisor.

If you are starting to sell alcoholic beverages for the first time, you may not have any experience selling alcoholic beverages. In that case, you will need to hire someone with experience in liquor sales as a liquor sales manager or take the liquor sales management training described above.

The appointment of the liquor sales manager is "until the time the license is granted". In other words, it is not necessary to appoint one at the time of applying for a license. In that case, it is necessary to clarify who is to be appointed as the liquor sales manager and, if that person has no experience in liquor sales, when he/she will receive the liquor sales management training.

Publication of Names, etc. of Persons Licensed to Sell Alcoholic Beverages

When a sales business license is granted, the National Tax Agency keeps the following information about the licensee: (1) date of license, (2) date of application, (3) name and corporation number of the licensee, (4) location of sales place, (5) alcoholic beverages licensed, and (6) processing category (new, transfer, etc.) from the end of the month following the date the license was granted.

Points to keep in mind when applying for a license to sell alcoholic beverages

In order to sell alcoholic beverages, you must obtain a "liquor sales business license. Regardless of whether you handle liquor at retail, online, wholesale, or for tax purposes, you must obtain a license in accordance with the procedures set forth by the National Tax Agency.

Below are some of the key points and points to keep in mind when applying for a liquor sales license.

1. clarify the type of license

There are several types of liquor sales licenses, and the choice must be based on the sales method and the target of the transaction.

| Type of license | Main Features |

| General liquor retailer license | Selling alcohol to the general public in stores (excluding restaurants) |

| Mail order liquor retailer license | Mail order sales of alcoholic beverages over the Internet, etc. |

| Liquor wholesale license (various types available) | Conduct business with other vendors (other liquor distributors, restaurants, etc.) |

| Alcoholic Beverage Manufacturing License | Manufacture its own alcoholic beverages (with fairly stringent requirements) |

2. applicant requirements

- Must be an adult (20 years of age or older)

- Not prohibited by law, such as bankrupt or ex-convict

- Ability to conduct business on an ongoing basis.

- No serious violations of liquor tax laws or other serious violations in the past

3. business office requirements

- Must have an office/store with substance

- The business location must be suitable for the sale of alcoholic beverages

- Treated differently from a restaurant with a business license (retail license required)

4. human requirements

- The "Liquor Sales Management Training Course" was attended.Liquor Sales ManagerThe "Mere Old Man" is required to appoint a "Mere Old Man".

- Managers are required to attend training on a regular basis (every three years).

5. management system for books and records

A system must be in place to maintain records on the purchase and sale of alcoholic beverages and submit them to the tax office.

Preparation of Application Documents and Attachments

The main documents to be submitted are listed above.

The application should be submitted to the tax office with jurisdiction over the area where the liquor sales place is located.

The application for a liquor license requires the preparation, preparation, and submission of a very large number of documents.

All documents must be prepared correctly and without omission, and even one incomplete application will be denied and the applicant will have to resubmit the application.

8. review period and cost

- Review Period:About 2 to 3 months

- Application Fee:Free of charge in principle(*An additional fee is required when requesting an administrative scrivener.)

summary

How was it?

The application for a liquor sales license is one of the more difficult of the many applications for permits and licenses. If you intend to sell alcoholic beverages, you should make preparations as early as possible.

In addition, the tax office with jurisdiction over the place of sale is the application destination for the liquor sales business license, but this is excluded from the tax accountant's services. Gyoseishoshi Lawyer can assist you in requesting a specialist. Gyoseishoshi-soshi (administrative scriveners) have the statutory exclusive business of preparing documents to be submitted to public offices and consulting on their behalf, and the Gyoseishoshi-soshi Law prohibits anyone other than an administrative scrivener from preparing such documents or making applications on behalf of others at the request of others.